rhode island property tax rates 2020

Questions related to taxes and taxes due should be directed to the Finance OfficeTax Collections. Below are the 10 towns in Rhode Island with the highest property tax rates.

Property Taxes By State 2017 Eye On Housing

There is a 75 and a 5 difference.

. Counties in Rhode Island collect an average of 135 of a propertys assesed fair market value as property tax per year. If you wish to pay your tax bill in Town Hall please go to the Finance Department on the first floor of Town Hall 514 Main Street. Current and Prior Tax Rates.

75 of NADA Value and a 5000 ExemptionAll rates are per 1000 of assessment. One Capitol Hill Providence RI 02908. 7 Rates rounded to two decimals 8 Denotes homestead exemption available.

FREQUENTLY ASKED QUESTIONS. 135 of home value Tax amount varies by county The median property tax in Rhode Island is 361800 per year for a home worth the median value of 26710000. West Greenwich has a property tax rate of 2403.

1 Rates support fiscal year 2020 for East Providence. Central Falls has a property tax rate of 2376. File Your Return Make a Payment Check Your Refund Register for Taxes.

Motor Vehicle Tax Rate-2020 2967 per 1000 500 State Exemption and 3500 Town Exemption per vehicle. 6 unit apt Commercial Industrial Mixed Use. The current tax rates for the 2021 Tax Bills are.

Paying your Tax Bill. 2021 Tax Rates. East Providence City Hall 145 Taunton Ave.

Please be advised that property assessment information can only be obtained through the Tax Assessors Office. Data collectors always carry a letter of identification from the Assessors Office a photo ID badge and have their cars registered with the Police Department. 3000thousand dollars of valuation.

1427 for Real Estate and Tangible Property. Detailed Rhode Island state income tax rates and brackets are available on. Find Details on Rhode Island Properties Fast.

3 West Greenwich - Vacant land taxed at 1696 per thousand of assessed value. East Providence RI 02914 401 435-7500. The Tax Rates for the Tax Roll Year 2020 Real Estate 1432 per 1000 Motor Vehicle 1987 per 1000 at 80 of NADA value with a 4000 exemption Tangible 2864 per 1000 Motor Vehicle Tax All Rhode Island residents who own and register a motor vehicle or trailer must annually pay a motor vehicle excise tax.

West Greenwich - Vacant land taxed at. 1 to 5 unit family dwelling Residential Vacant Land. Rhode Island Property Taxes Go To Different State 361800 Avg.

Learn About Owners Year Built More. Johnston has a property tax rate of 2324. The current tax rates and exemptions for real estate motor vehicle and tangible property.

Ad Look Up Any Address in Rhode Island for a Records Report. Rates support fiscal year 2021 for East Providence. 1915thousand dollars of valuation.

2020 Tax Rates by Municipality Report by RI Division of Finance. Tangible - 19404 Department Details The primary function of the Tax Collectors office is to collect and record taxes owed by the residents of Coventry. 2989 - two to five family.

The project commenced in January 2019. Woonsocket has a property tax rate of 2375. What exactly is a.

3000 for every 1000. 2700 for every 1000. Property-tax relief credit maximum credit amount by tax year 2019 2020 38500 40000 Rules governing credit are shown on Form RI-1040H.

Administering RI state taxes and assisting taxpayers by fostering voluntary compliance through education and ensuring public confidence. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. 2020 Tax Rates.

The reassessment project will establish market value as of December 31st 2019 and will be reflected in the tax bills issued in the summer of 2020. Motor Vehicle - 1875. We offer many ways to pay taxes in order to make an unpleasant task as painless as possible.

The median annual property tax payment here is 4339. 1915thousand dollars of valuation. Tax Rates for Rhode Island in 2020 2021 Rhode Islands state income tax rate table for 2020 2021 has three income tax brackets with a 3 percent tax rate.

See Results in Minutes. 40 rows West Warwick taxes real property at four distinct rates. Providence has a property tax rate of 2456.

Rhode Island Division of Taxation. Municipality had a revaluation or statistical update effective 123120. 1915thousand dollars of valuation.

Current 2021 Tax Rates. 1800 for every 1000. Tax assessments are set annually as of December 31st.

That comes in as the tenth highest rate in the country. The Rhode Island Division of Taxation office is open to the public 830 am. 2 Municipality had a revaluation or statistical update effective 123119.

FY2022 starts July 1 2021 and ends June 30 2022Residential Real Estate - 1873Commercial Industrial Real Estate - 2810Personal Property - Tangible - 3746Motor Vehicles - 3000Motor vehicle phase out exemption. Rhode Island has some of the highest property taxes in the US as the state carries an average effective rate of 153. Motor Vehicles has a fixed tax rate of 1914.

2700 for every 1000. See also Rhode Island General Laws 44-33-1 et seq.

Riverside County Ca Property Tax Calculator Smartasset

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Property Taxes How Much Are They In Different States Across The Us

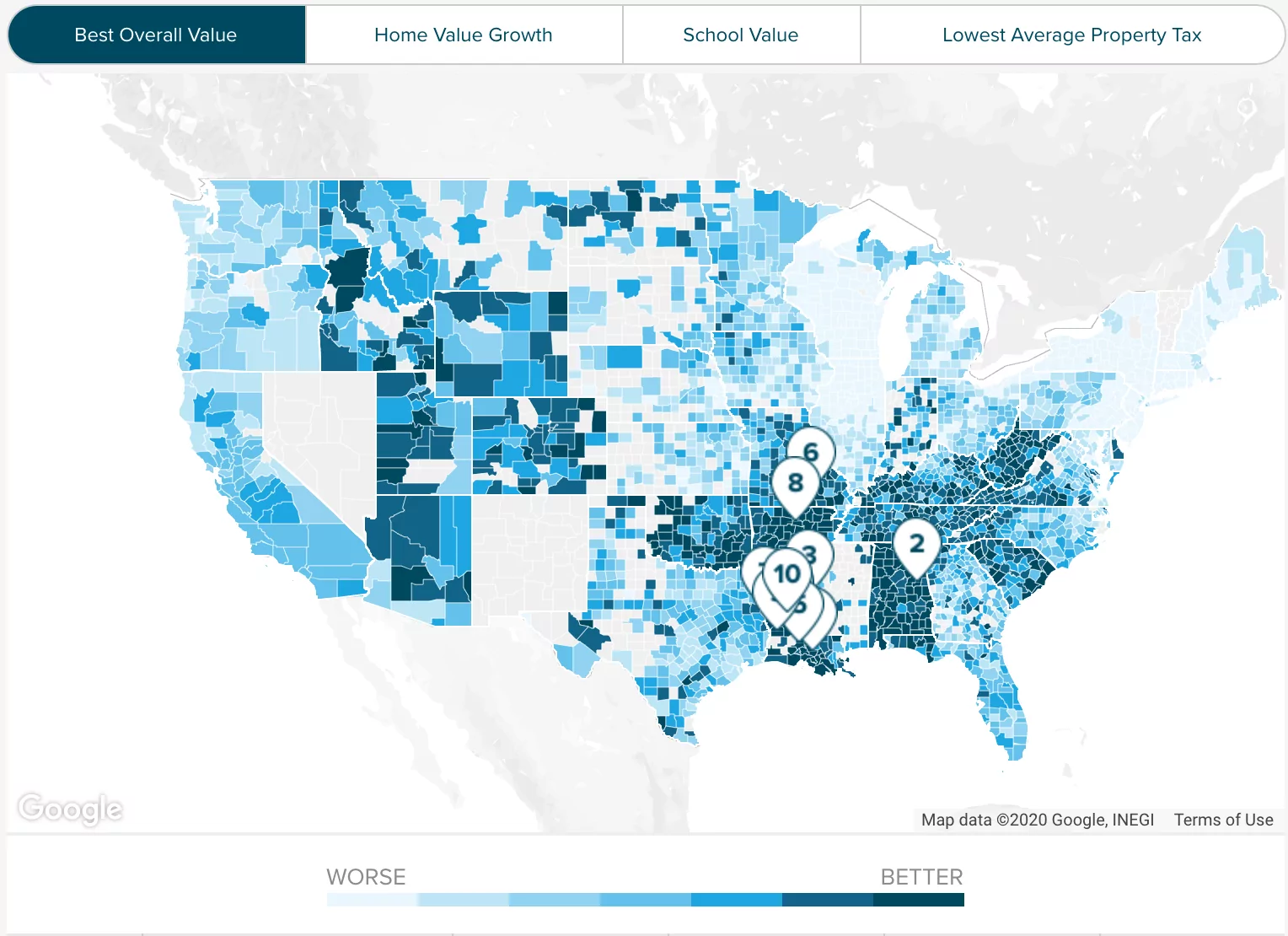

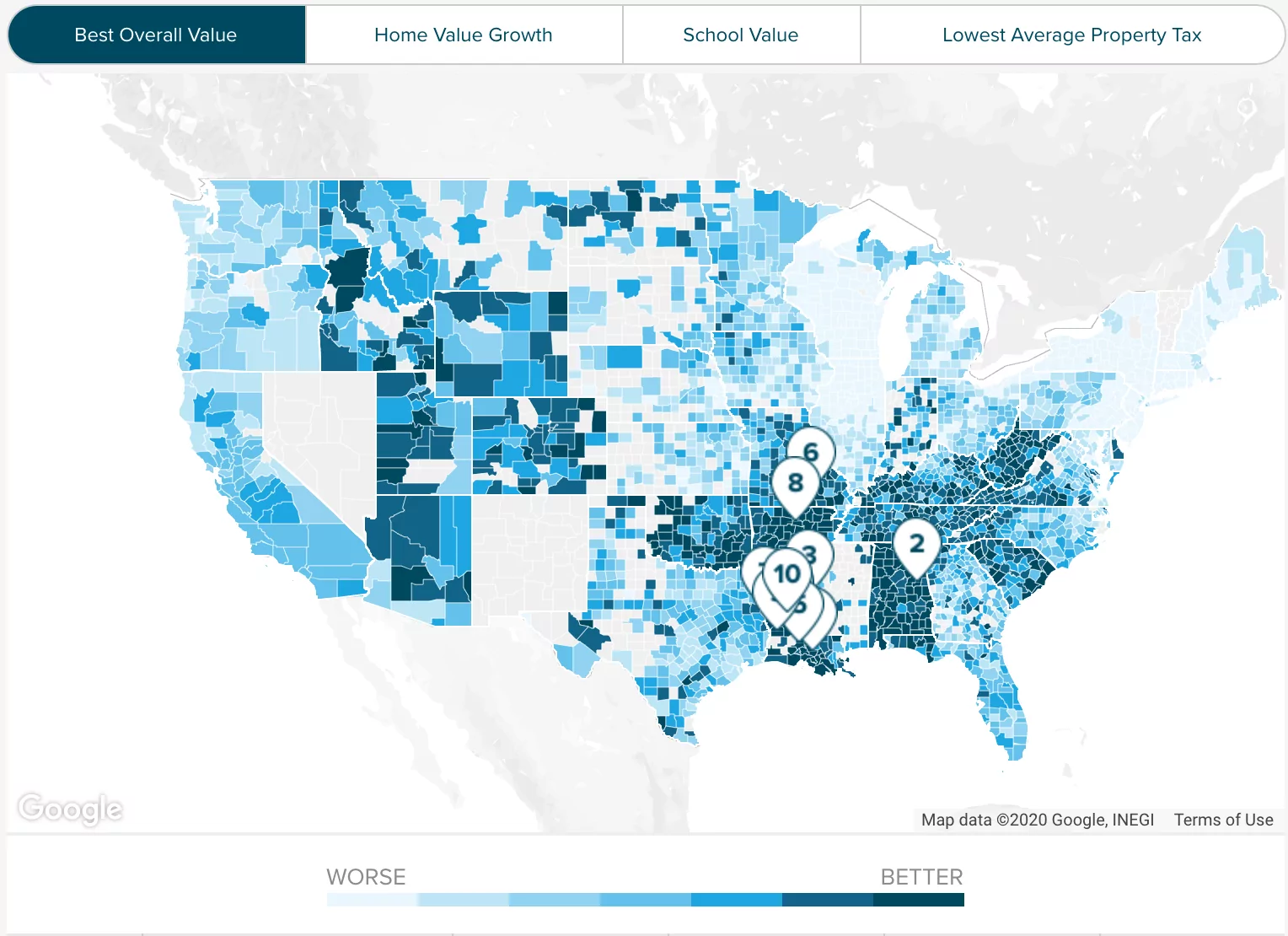

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Property Taxes By State Embrace Higher Property Taxes

Rhode Island Property Tax Calculator Smartasset

Property Tax Comparison By State For Cross State Businesses

Property Taxes By State 2017 Eye On Housing

New York Property Tax Calculator 2020 Empire Center For Public Policy