when will i see my unemployment tax refund

For this round the average refund is 1686 direct deposit refunds started going out Wednesday and paper checks today. Visit IRSgov and log in to your.

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion.

. The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable amount of unemployment compensation and tax. This includes unpaid child support and state or federal taxes. See How Long It Could Take Your 2021 State Tax Refund.

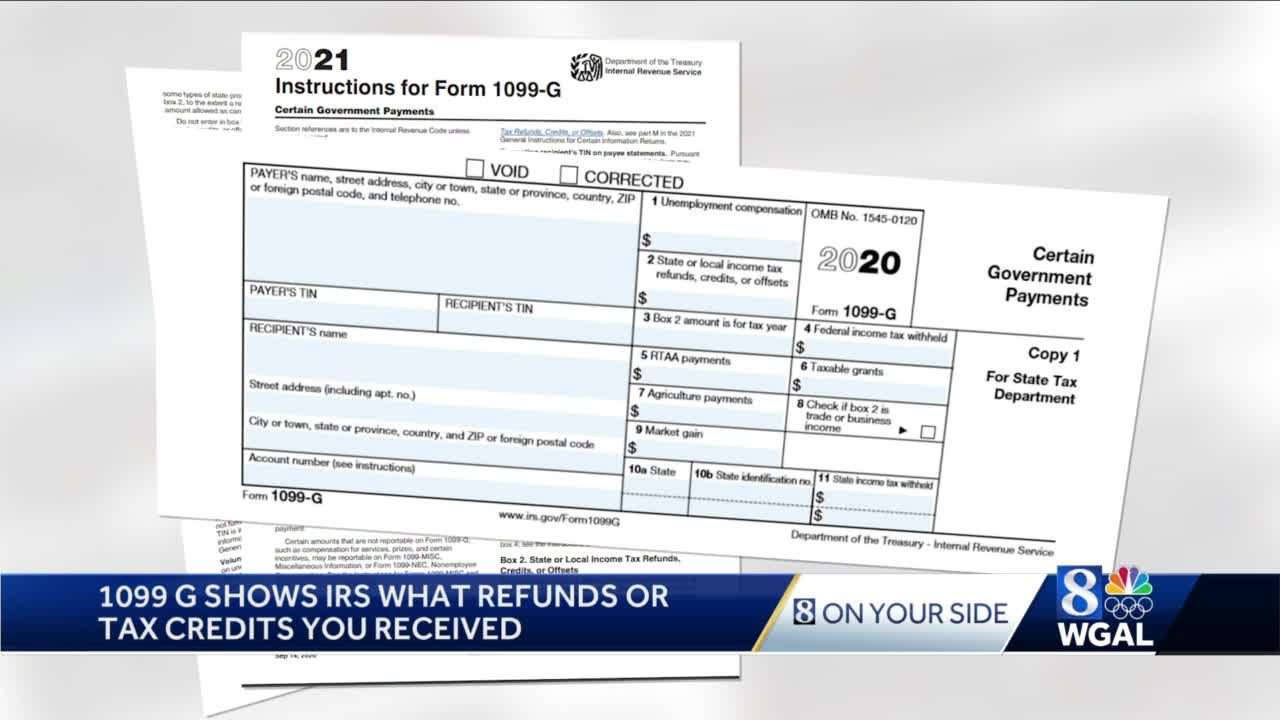

Heres how to check online. Another way is to check your tax transcript if you have an online account with the IRS. For eligible taxpayers this could result in a refund a reduced balance due or no change to tax.

An immediate way to see if the IRS processed your refund and for how much is by viewing your tax records online. This is the fourth round of refunds related to the unemployment compensation exclusion provision. Ad Learn How Long It Could Take Your 2021 State Tax Refund.

If you claimed unemployment last year but. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket. When Will I Receive My Unemployment Tax Refund.

The IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool will not likely provide information on the status of your unemployment tax refund. The only way to see if the IRS processed your refund online is by viewing your tax transcript. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30.

1 day agoThe governor said the tax break is possible because the state is in a surplus and also promises rebates for residents and homeowners. Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit. The unemployment tax refund is only for those filing individually.

Check For the Latest Updates and Resources Throughout The Tax Season. The agency is working its way down to the more complex category and expects to complete releasing jobless tax refunds before Dec. COVID Tax Tip 2021-87 June 17 2021.

The IRS has sent letters to taxpayers. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset debt. June 4 2021 214 PM CBS Chicago.

Reporting unemployment benefits on your tax return You report your unemployment compensation on Schedule 1 of your federal tax return in the Additional Income section. CBS -- The Internal Revenue Service is sending more than 28 million refunds this week to taxpayers who paid taxes on unemployment compensation. The Unemployment Insurance Act was recently amended to provide for the personal liability of any officer or employee of an employer who has control supervision or responsibility for the filing of reports or the payment of contributions payments in lieu of contributions penalties or interest for the employer and who willfully fails to file the reports or make the payments.

But the unemployment tax refund can be seized by the IRS to pay debts that are past due. Illinois residents who received unemployment benefits in 2020 and filed their income taxes before March 15 can expect refunds from the Illinois Department of Revenue as a result of a recently. Sadly you cant track the cash in the way you can track other tax refunds.

The amount will be carried to the main Form 1040. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their 2020 tax returns. CHICAGO The Illinois Department of Employment Security on Monday announced the regular unemployment rates for 2019 will be lower for more than 92 percent of the states employers who.

Solved The IRS started with making payments to those who had filed simple returns such as single filers.

Is There A Way To Find My Unemployment Id Number In The Platform

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

/1099g-b89de84cce054844bd168c32209412a0.jpg)

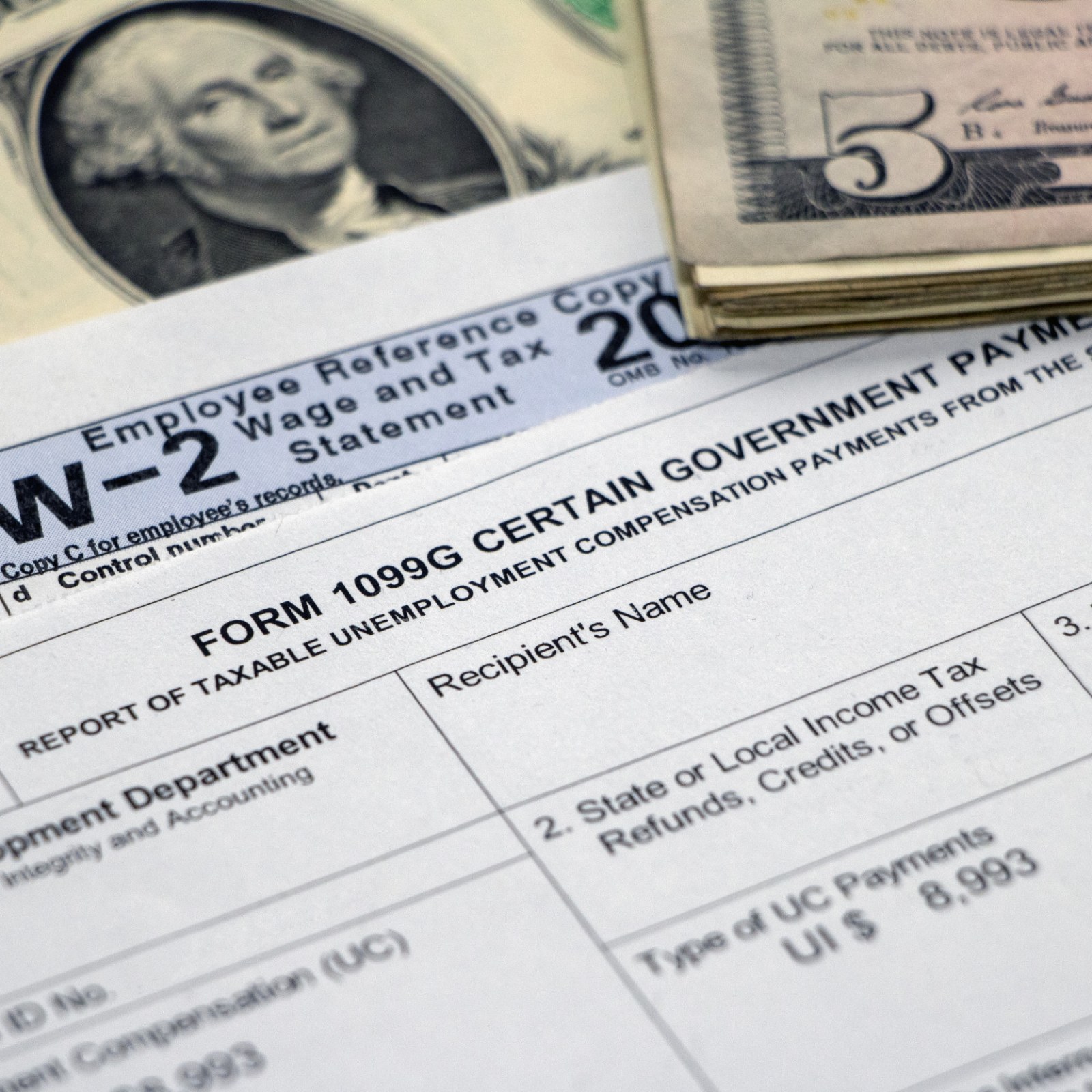

Form 1099 G Certain Government Payments Definition

1099 G Tax Form Why It S Important

1099 G Unemployment Compensation 1099g

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

What To Keep In Mind About Your Unemployment Tax Refunds Wztv

I M Confused By My Transcript What Does This Mean For Dates 4 15 Codes 766 And 768 Is This My Refund Because I Think They Are Missing Refundable Credits My Refund Should Be

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

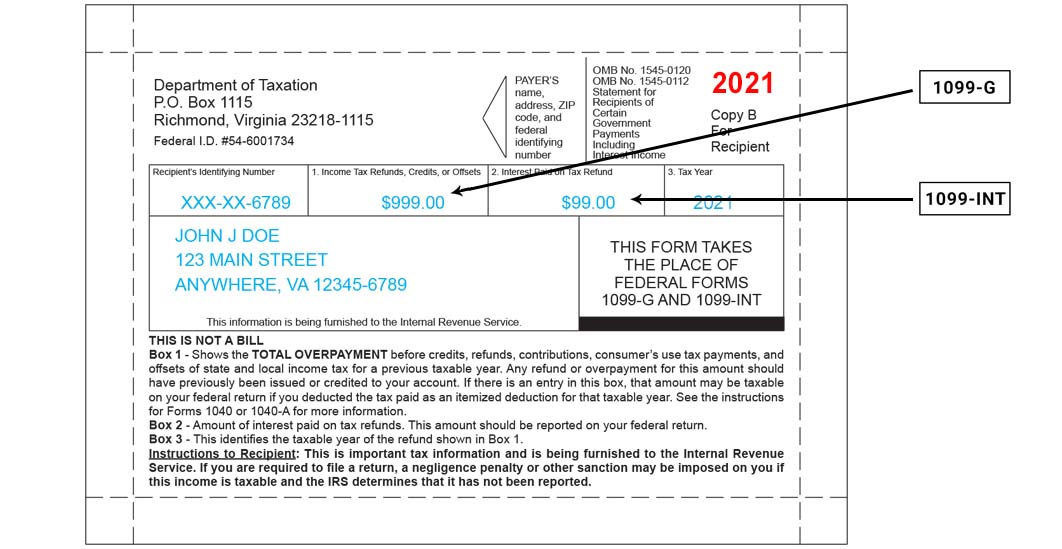

1099 G 1099 Ints Now Available Virginia Tax

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time